Chart Centre

See our key financial metrics and diagrams.

Jump to

-

Performance Overview

-

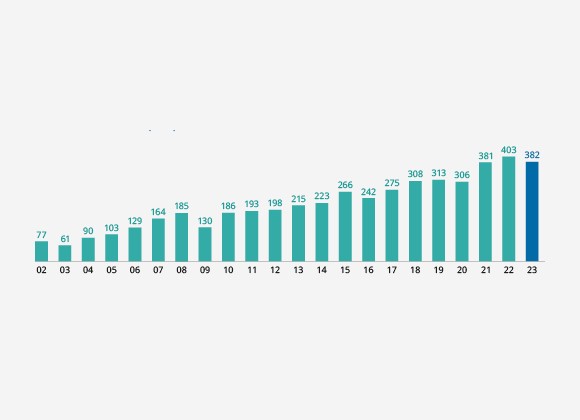

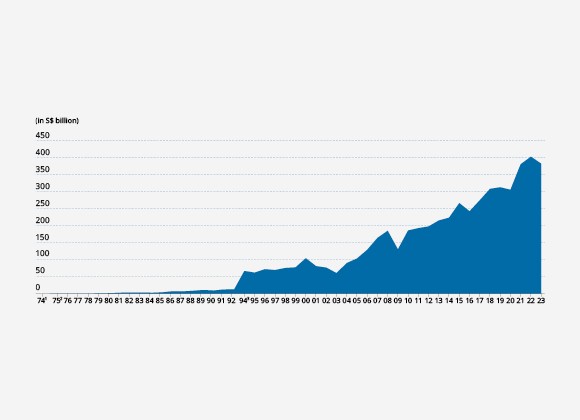

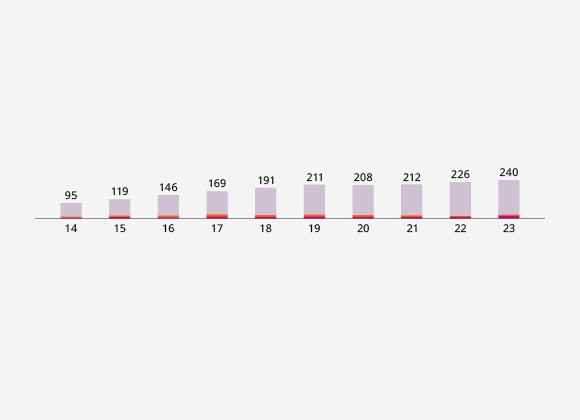

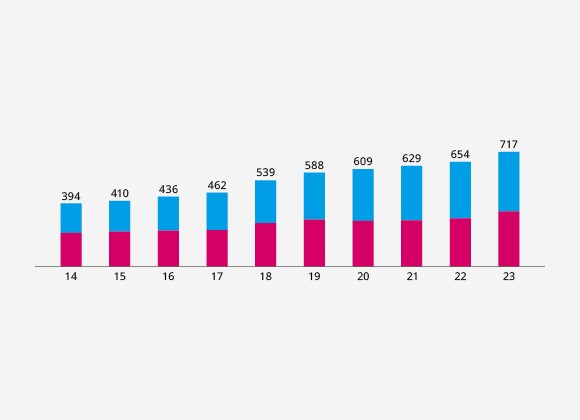

Net Portfolio Value (S$b)

-

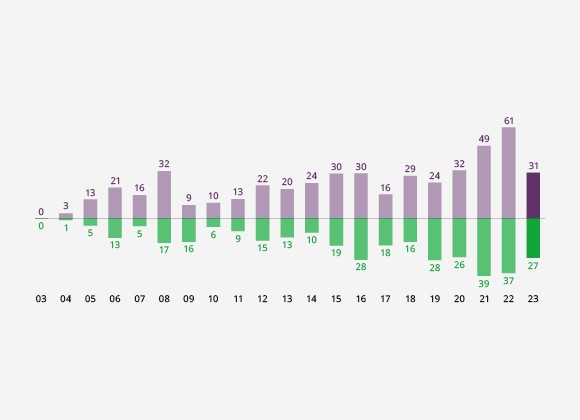

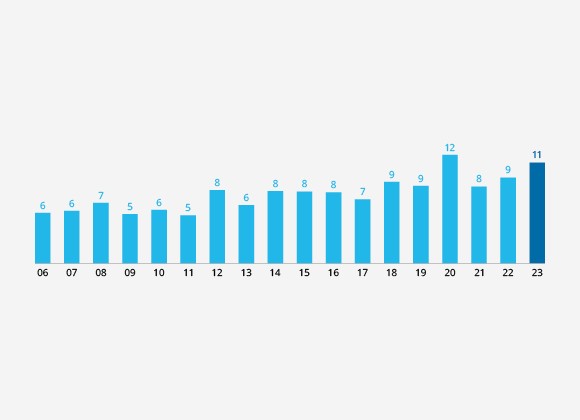

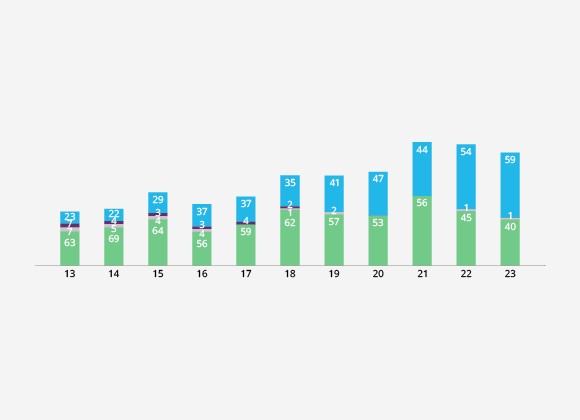

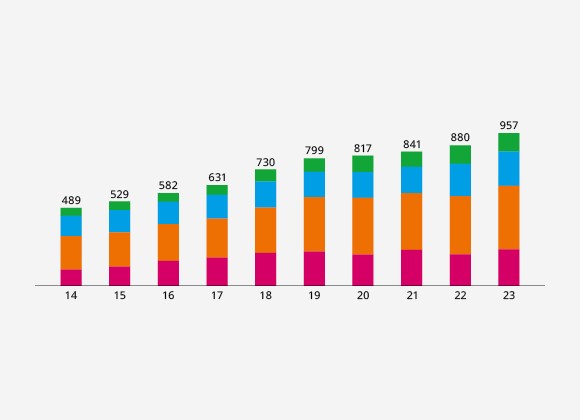

Investments & Divestments (S$b)

-

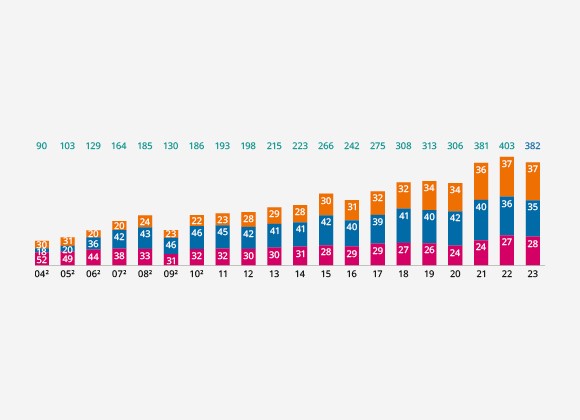

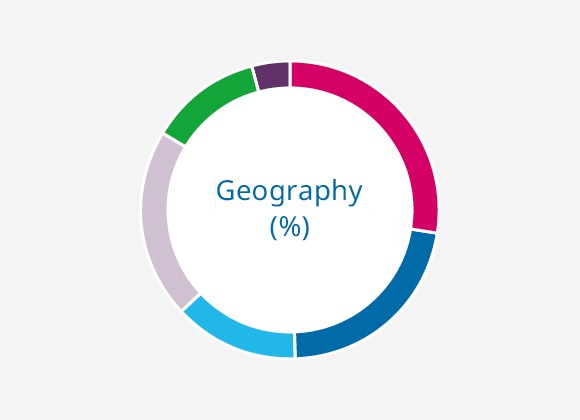

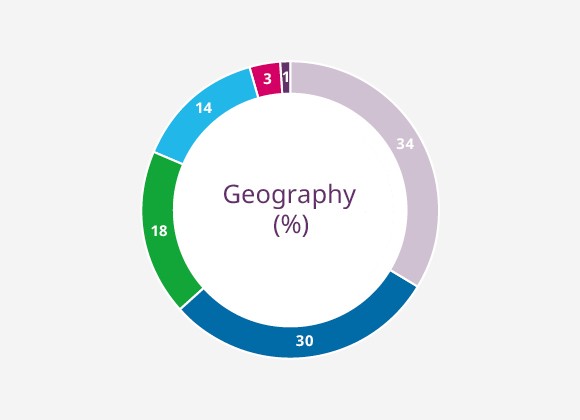

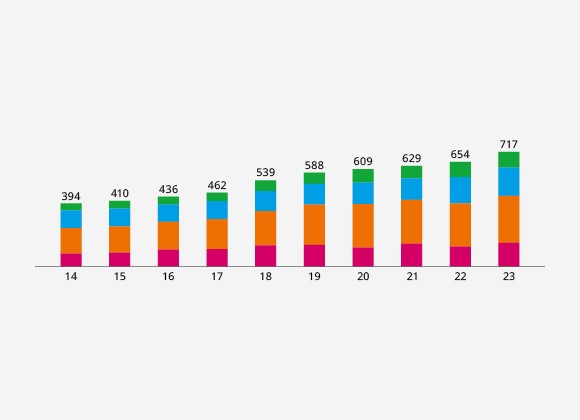

Portfolio by Geography (%)

-

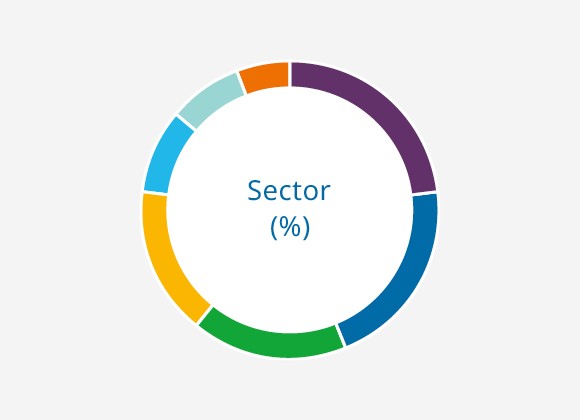

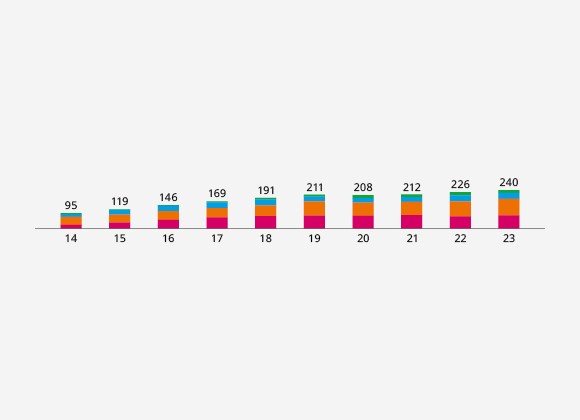

Portfolio by Liquidity (%)

-

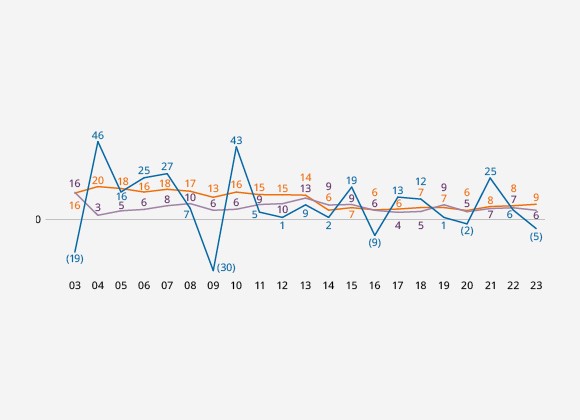

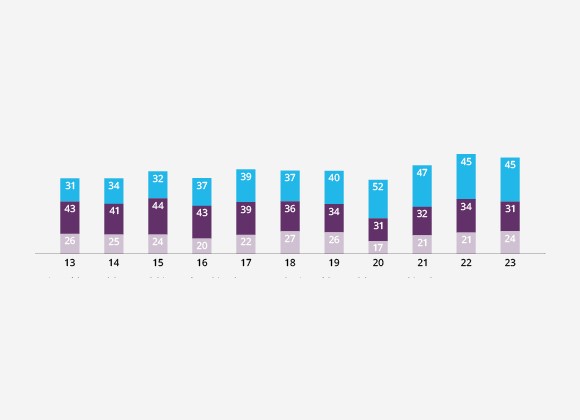

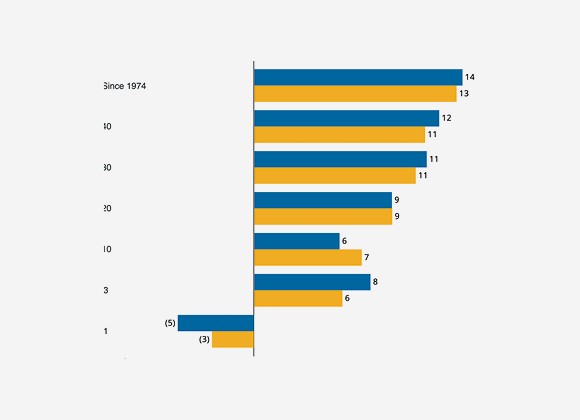

S$ Total Shareholder Return (%)

-

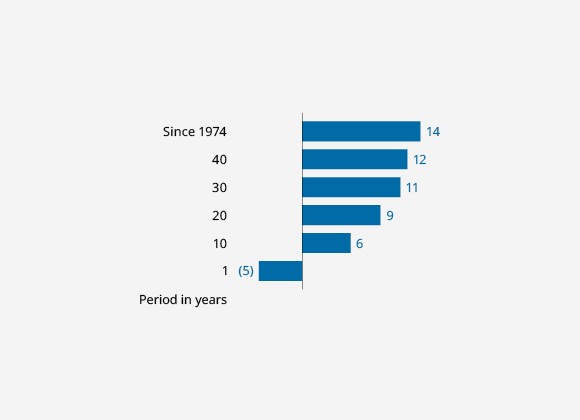

Rolling S$ Total Shareholder Return (%)

-

Dividend Income (S$b)

-

-

Portfolio Highlights

-

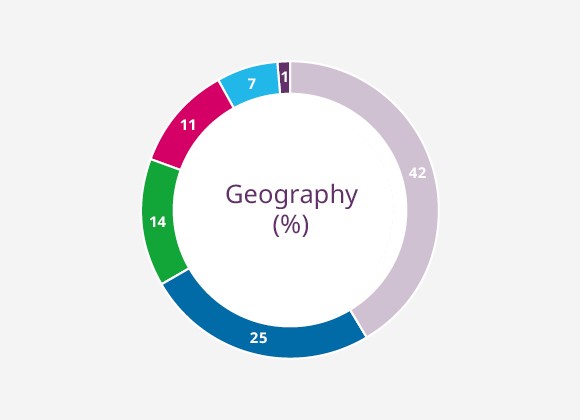

Geography (%)

-

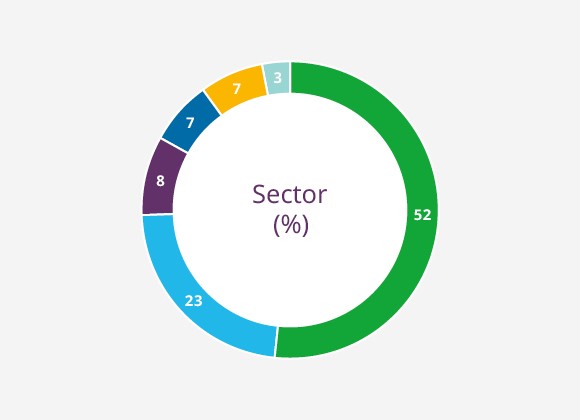

Sector (%)

-

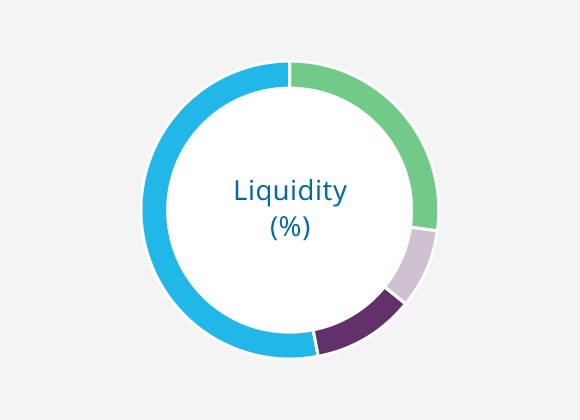

Liquidity (%)

-

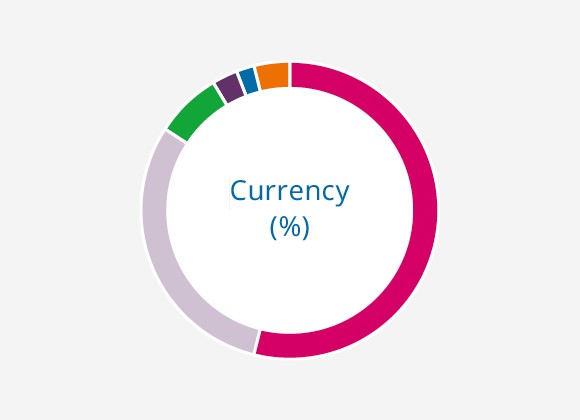

Currency (%)

-

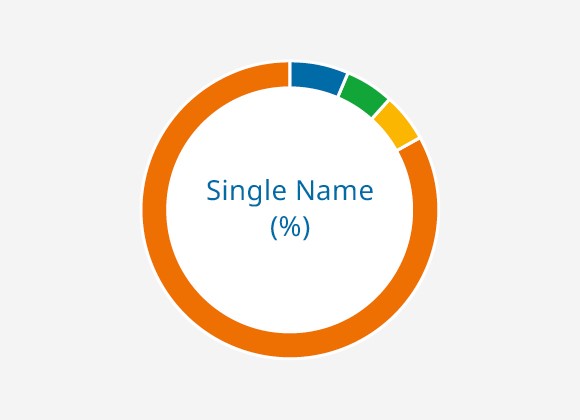

Single Name (%)

-

-

Navigating a Complex World

-

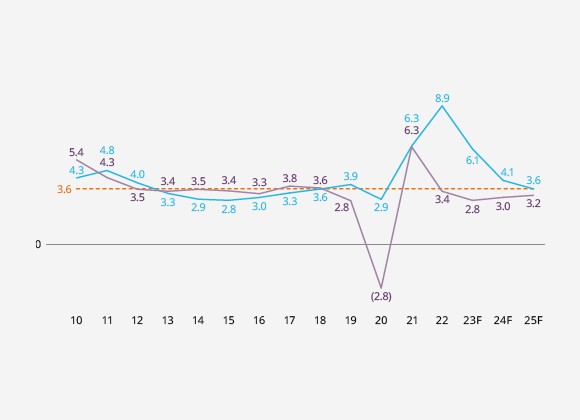

Global Real GDP Growth and Global Inflation Rate (%)

-

-

Pillars and Foundational Enablers

-

Our Four Key Pillars

-

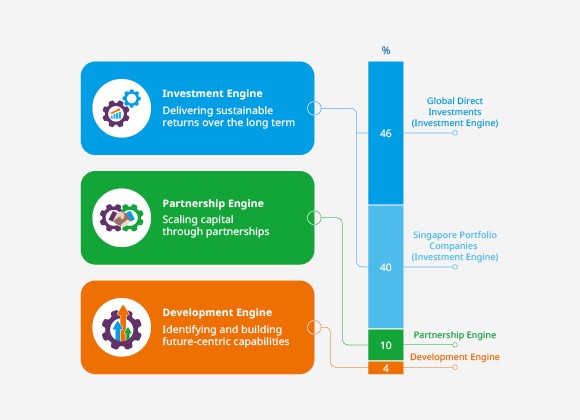

Three Growth Engines

-

Singapore Portfolio Companies by Liquidity (%)

-

Global Direct Investments by Liquidity (%)

-

Global Direct Investments by Geography (%)

-

Global Direct Investments by Sector (%)

-

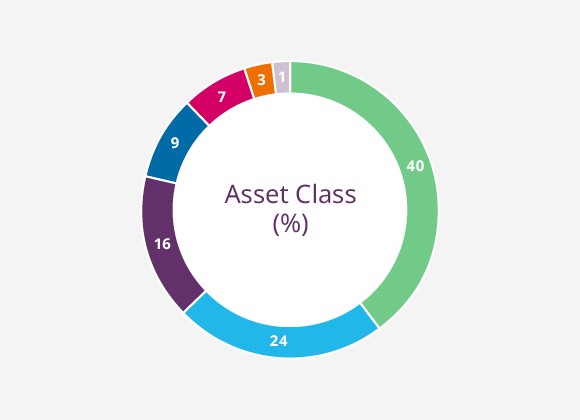

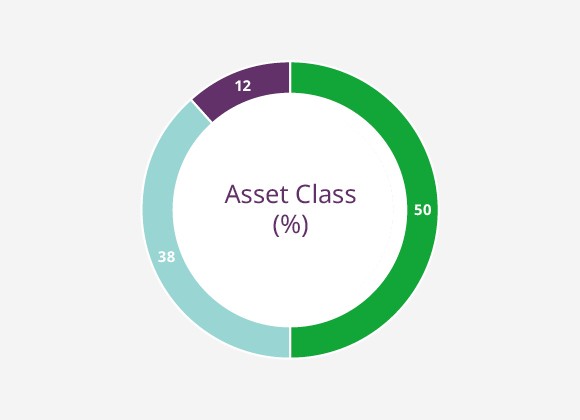

Global Direct Investments by Asset Class (%)

-

-

How We Invest

-

Four Structural Trends

-

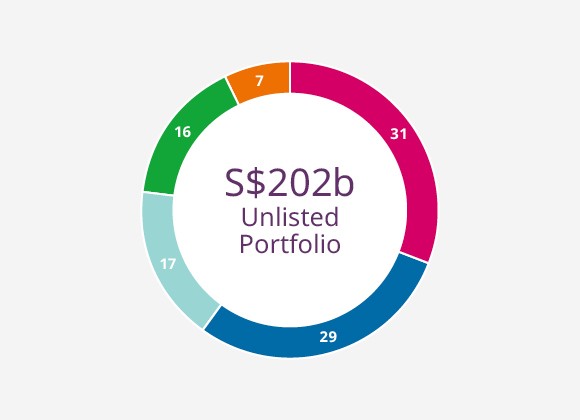

Unlisted Portfolio (%)

-

Early Stage Portfolio by Geography (%)

-

Early Stage Portfolio by Sector (%)

-

Early Stage Portfolio by Asset Class (%)

-

-

How We Grew

-

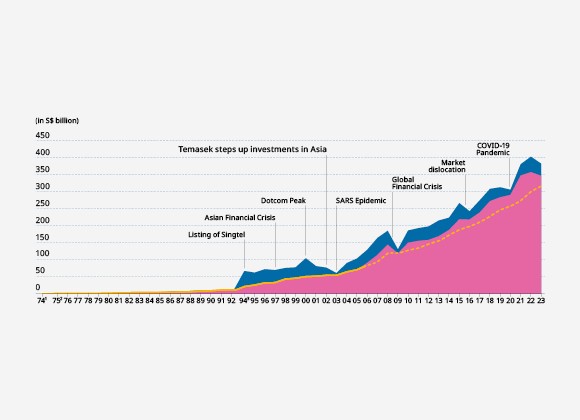

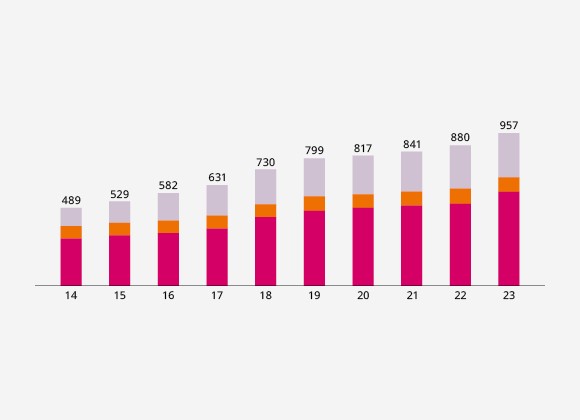

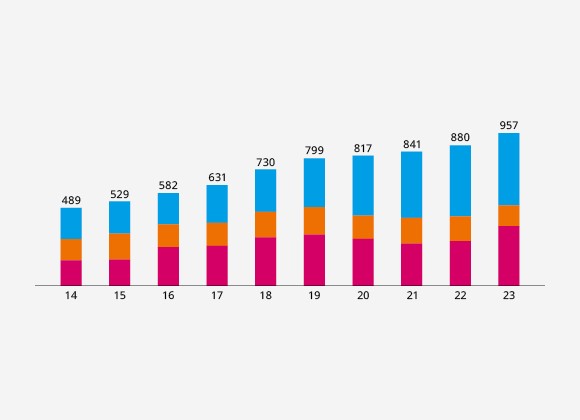

Temasek Net Portfolio Value since Inception

-

Relation between Net Portfolio Value and Total Shareholder Return

-

-

Total Shareholder Return

-

S$ Total Shareholder Return (%)

-

-

How We Manage Risks

-

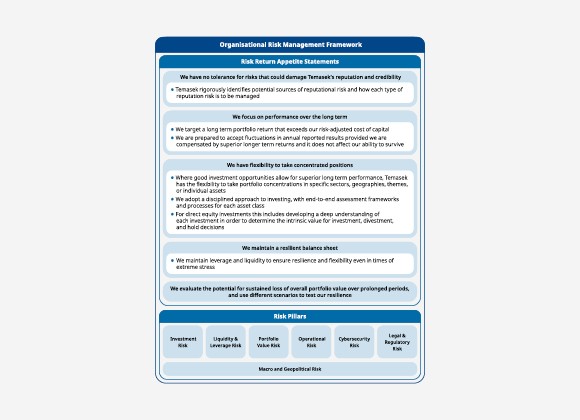

Organisational Risk Management Framework

-

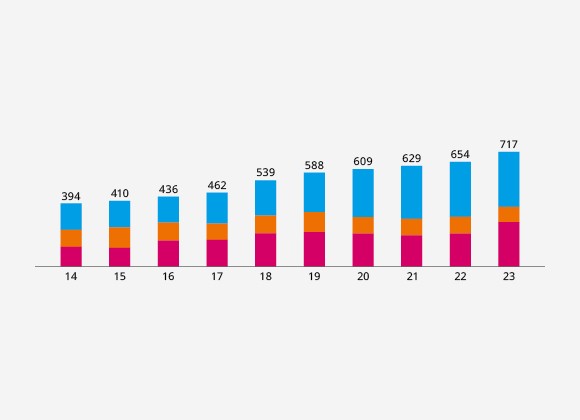

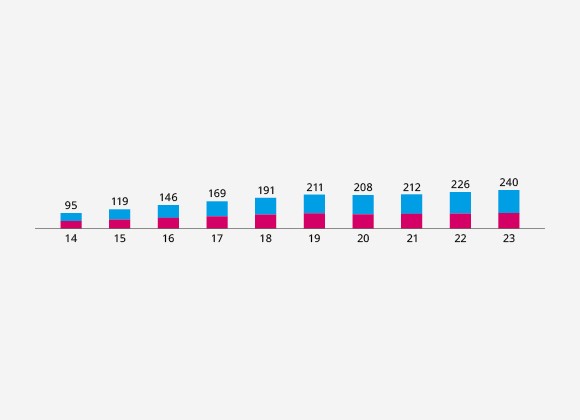

Key Recurring Income vs Debt Maturity Profile (S$b)

-

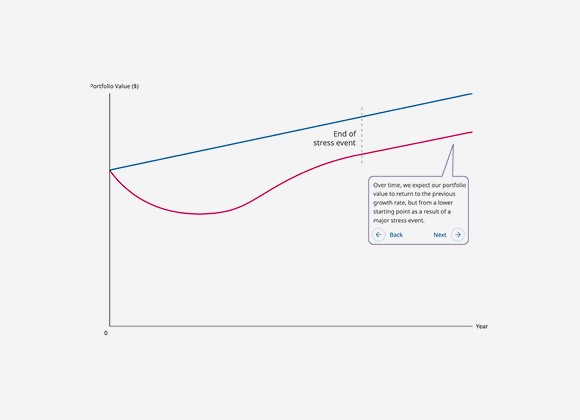

Illustration of Fundamental Earnings Impact

-

-

12-month Returns Simulation

-

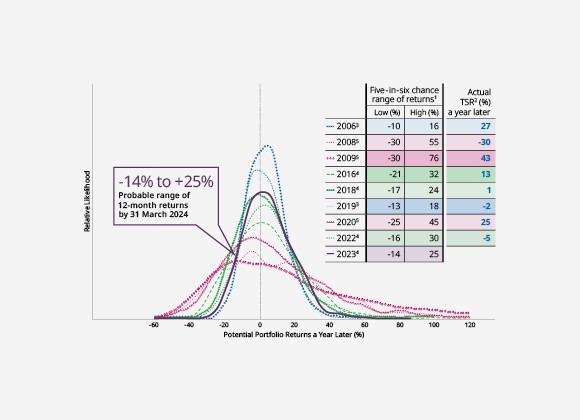

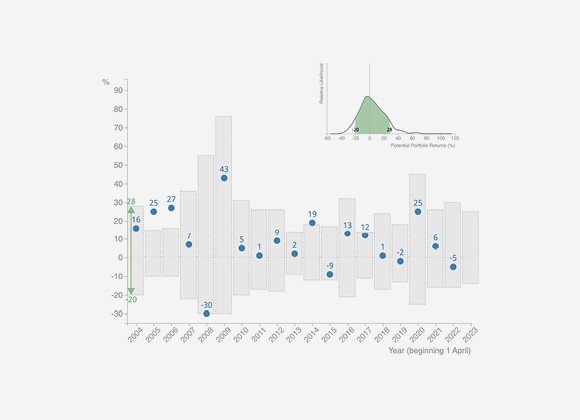

Simulation of 12-month Forward Portfolio Returns

-

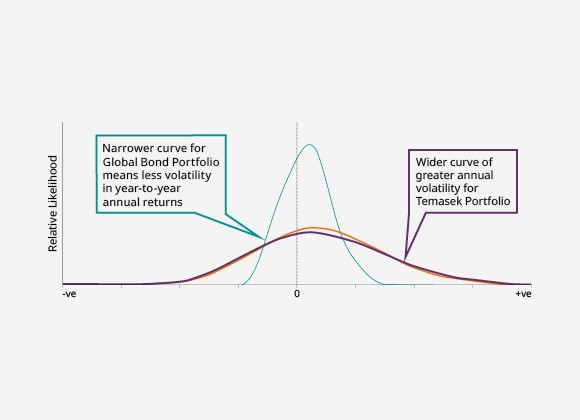

Volatility of Returns

-

-

20-year Returns Outlook

-

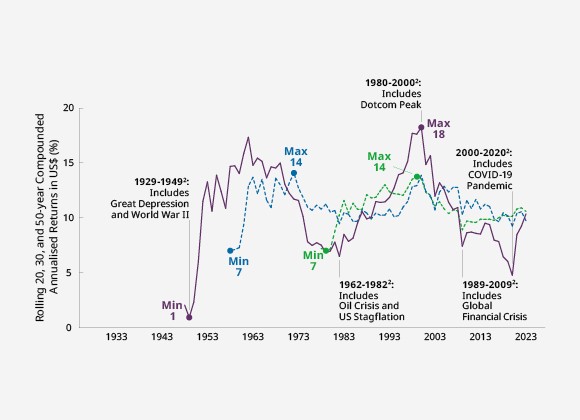

US Equity Rolling 20, 30, and 50-year Returns over Time (Compounded Annualised)

-

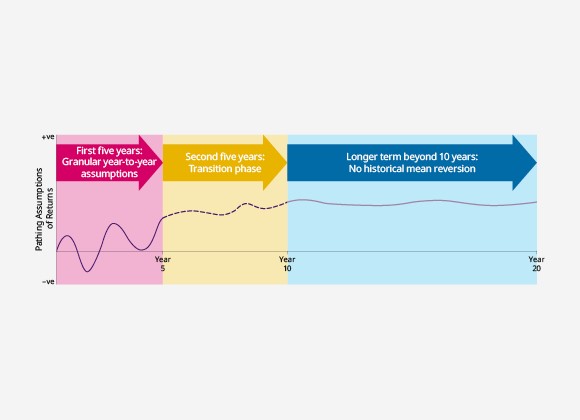

Economic Scenario Pathing (Illustrative)

-

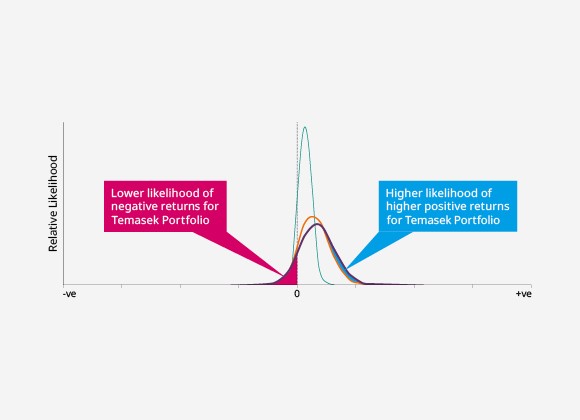

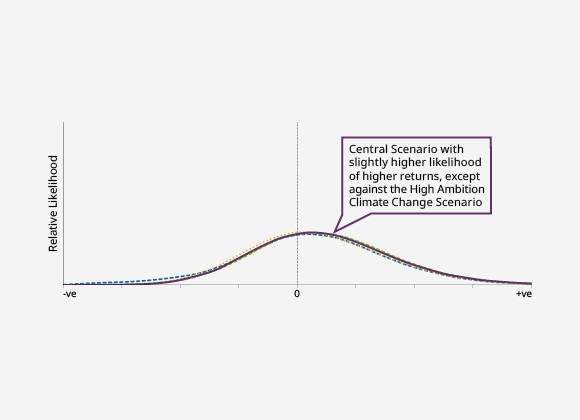

Likelihood of Geometric Returns (Compounded Annualised) at the End of 20-year Period, by Portfolio Mix

-

Likelihood of Year-to-year Annual Returns during 20-year Period, by Portfolio Mix

-

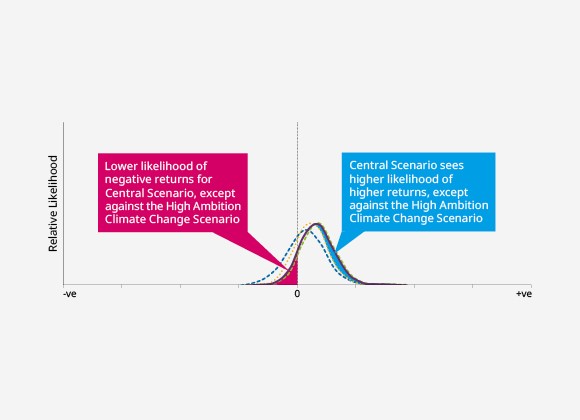

Likelihood of Geometric Returns (Compounded Annualised) at the End of 20-year Period, by Potential Scenario

-

Likelihood of Year-to-year Annual Returns during 20-year Period, by Potential Scenario

-

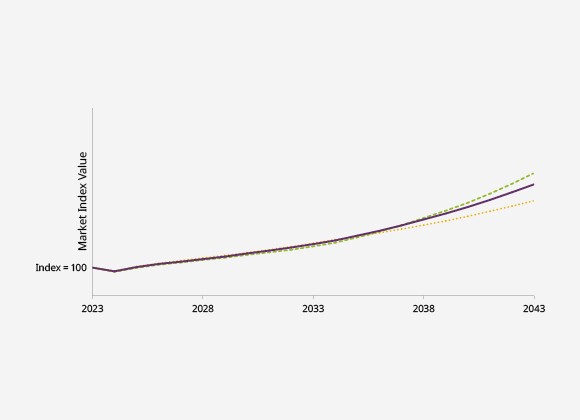

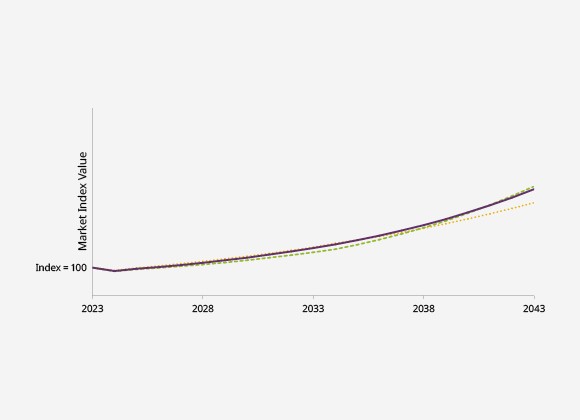

Market Index Value at the End of 20-year Period, by Potential Scenario (US)

-

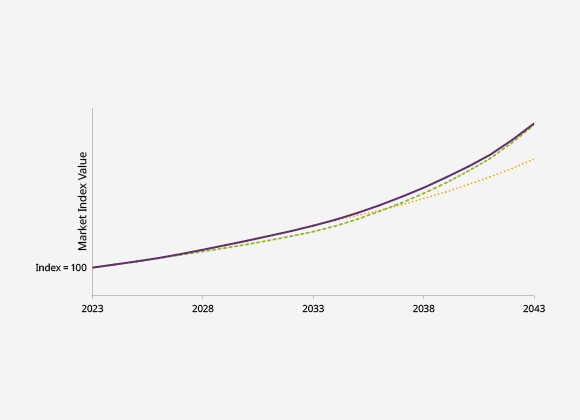

Market Index Value at the End of 20-year Period, by Potential Scenario (Eurozone)

-

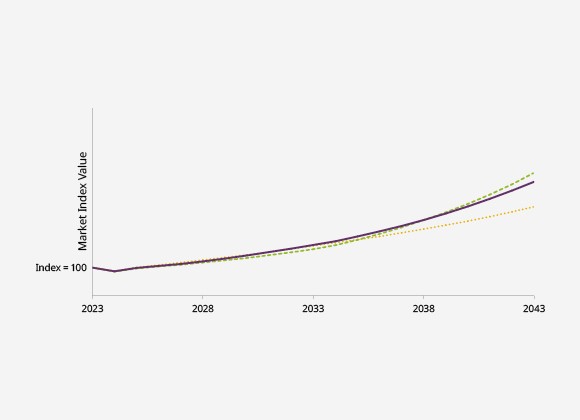

Market Index Value at the End of 20-year Period, by Potential Scenario (China)

-

Market Index Value at the End of 20-year Period, by Potential Scenario (Singapore)

-

-

Credit Profile

-

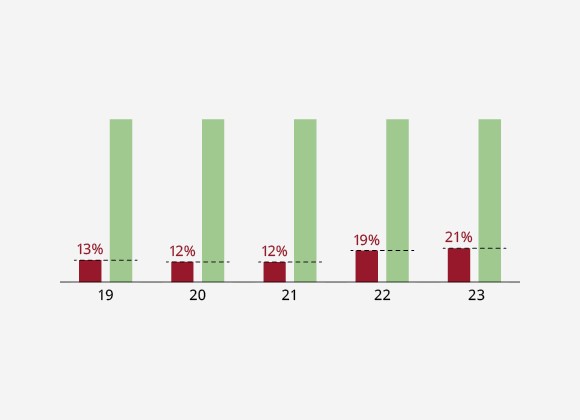

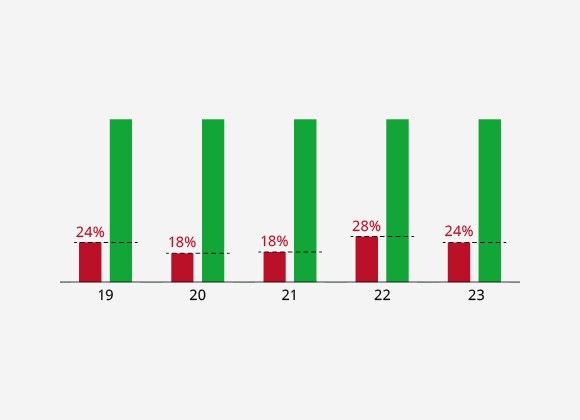

Total Debt 6% of Net Portfolio Value

-

Total Debt 21% of Liquid Assets

-

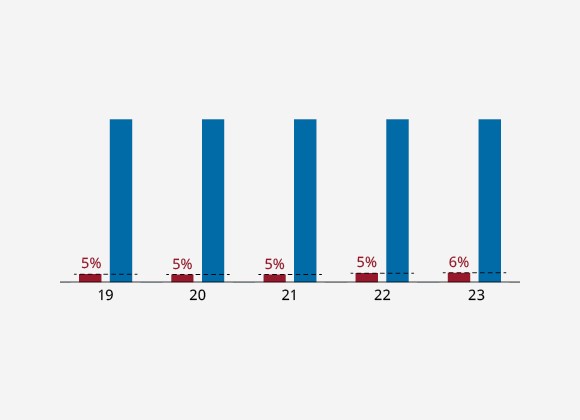

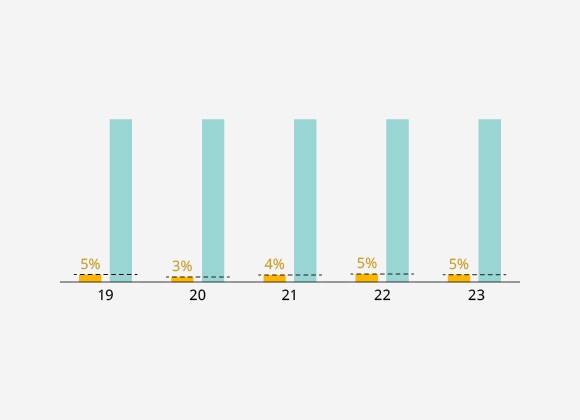

Interest Expense 5% of Dividend Income

-

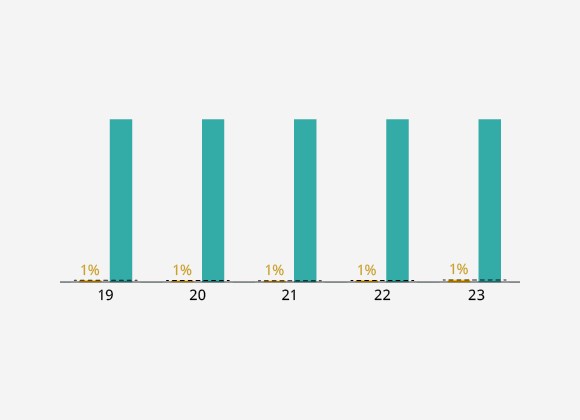

Interest Expense 1% of Recurring Income

-

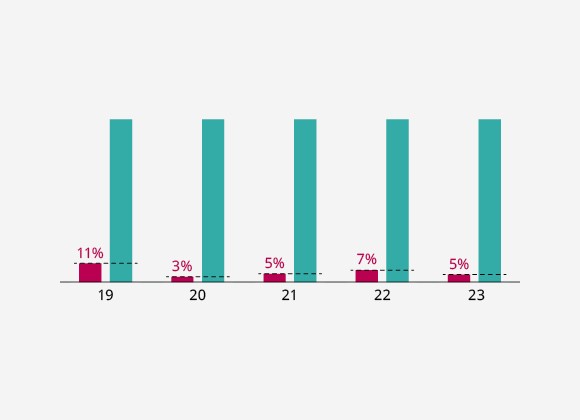

Total Debt due in One Year 5% of Recurring Income

-

Total Debt due in next 10 Years 24% of Liquidity Balance

-

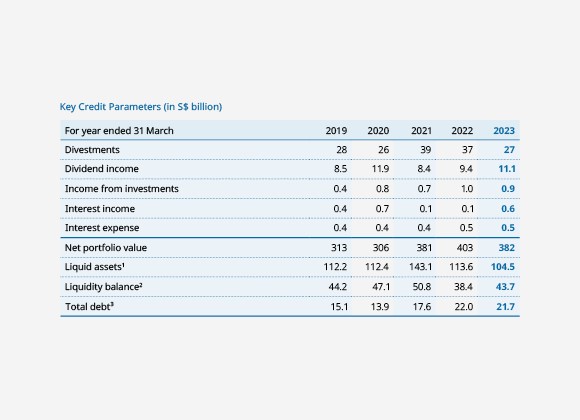

Key Credit Parameters (in S$ billion)

-

-

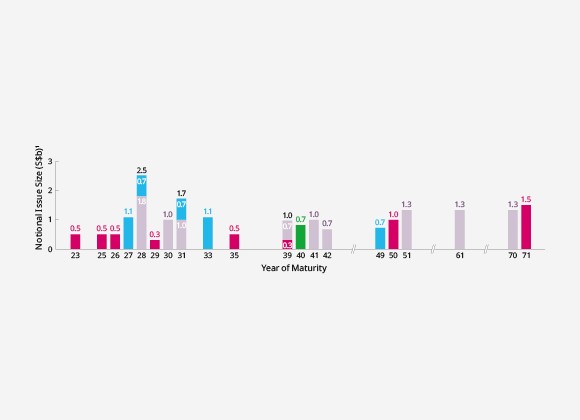

Temasek Bonds

-

Temasek Bonds - Maturity Profile

-

-

Engaging our Portfolio Companies

-

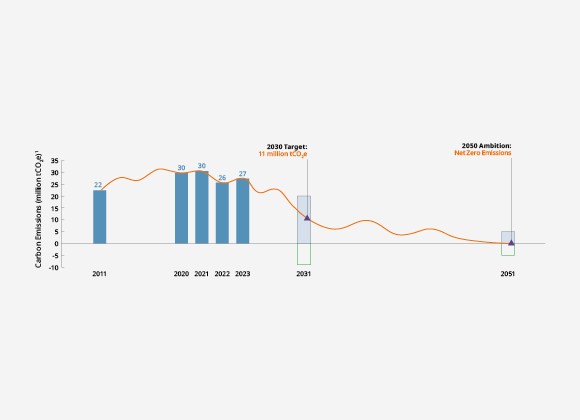

Towards Net Zero

-

-

Fostering Sustainability in Temasek

-

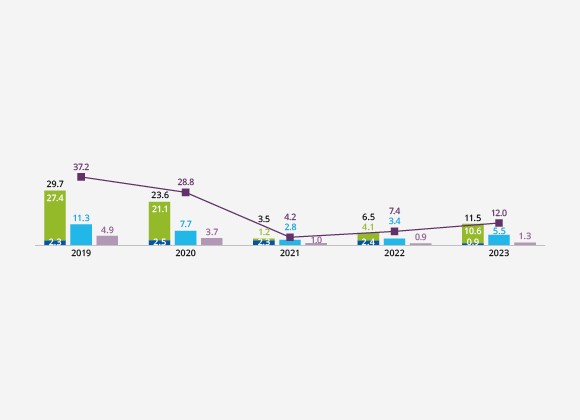

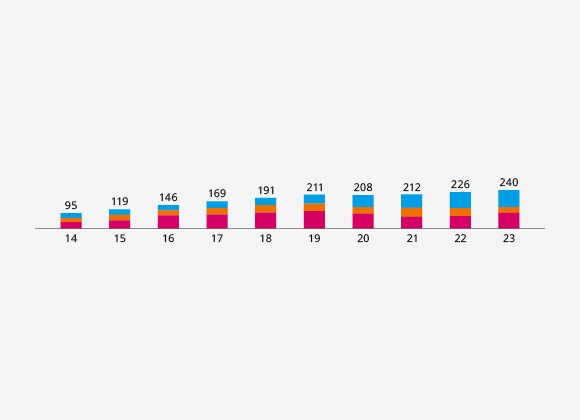

Five-year Environmental Footprint

-

-

Sustainability Indicators

-

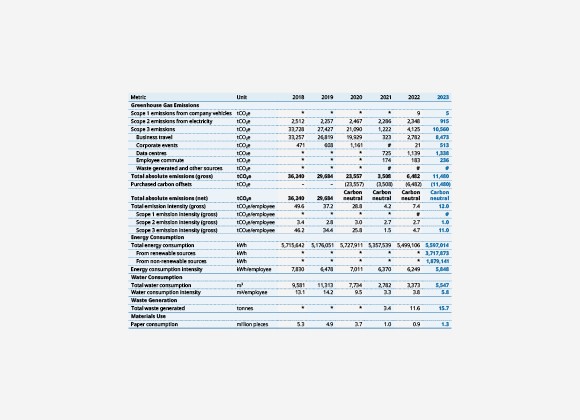

Sustainability Indicators: Our Operations

-

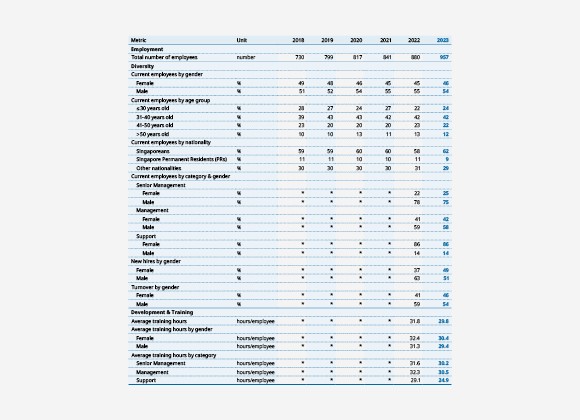

Sustainability Indicators: Our People

-

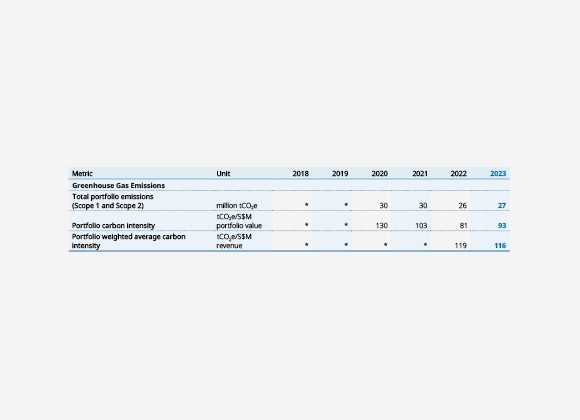

Sustainability Indicators: Our Portfolio

-

-

Wealth Added

-

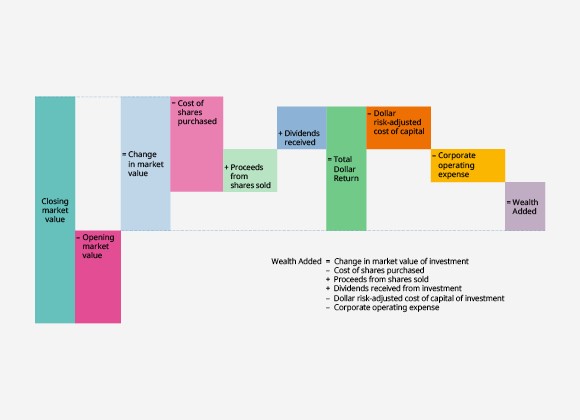

Illustration of Wealth Added

-

-

Instilling Ownership

-

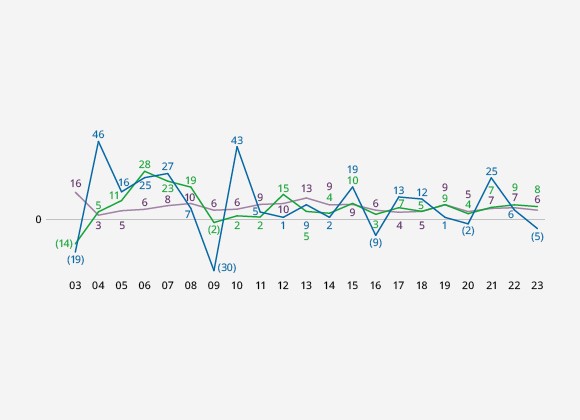

Rolling S$ Total Shareholder Return (%)

-

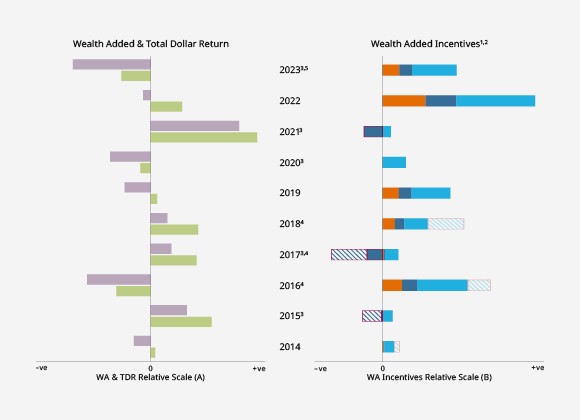

WA Incentives of Key Team

-

-

Our MERITT Values

-

Our MERITT Values

-

-

Our Temasek Heartbeat

-

Our Staff by Nationality - Global

-

Our Staff by Nationality - Singapore

-

Our Staff by Nationality - Outside of Singapore

-

Our Staff by Age - Global

-

Our Staff by Age - Singapore

-

Our Staff by Age - Outside of Singapore

-

Our Staff by Tenure - Global

-

Our Staff by Tenure - Singapore

-

Our Staff by Tenure - Outside of Singapore

-

Our Staff by Gender - Global

-

Our Staff by Gender - Singapore

-

Our Staff by Gender - Outside of Singapore

-

-

A Trusted Steward

-

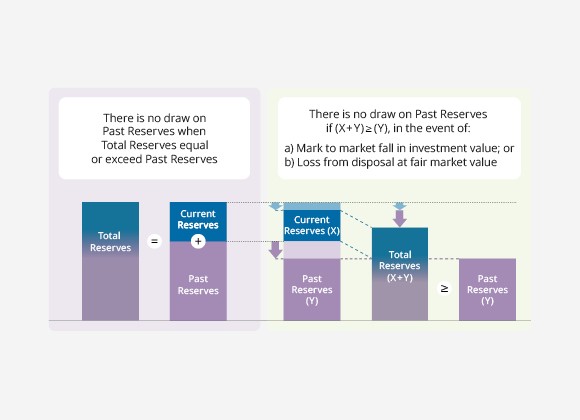

Protection of Temasek's Past Reserves

-

-

Fostering Stewardship and Governance

-

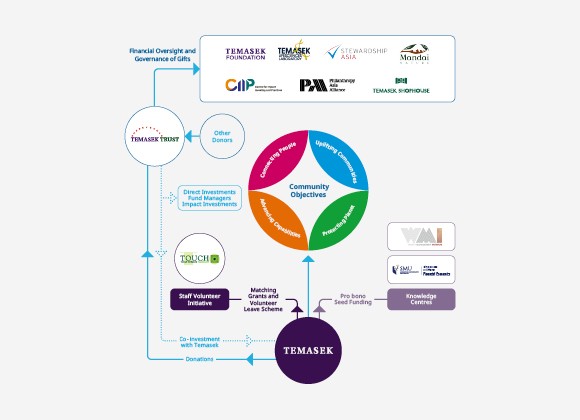

Fostering Stewardship and Governance

-

-

Enabling a Better World

-

Enabling a Better World

-

-

Our Major Investments

-

Our Major Investments

-

-

Adopting International Accounting Standards

-

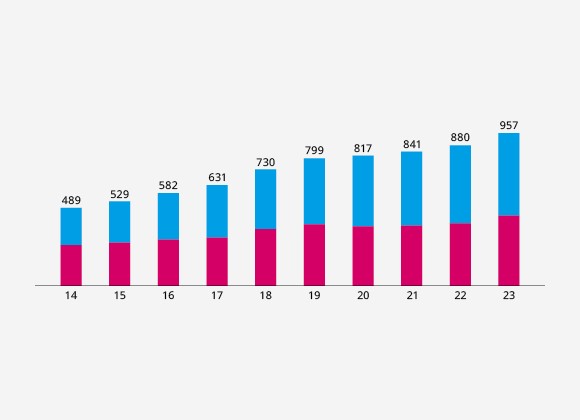

Group Net Profit/(Loss) (S$b) with and without Unrealised Gains or Losses of Sub-20% Investments

-

-

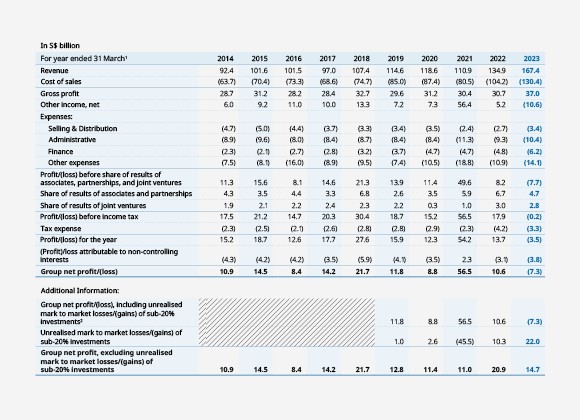

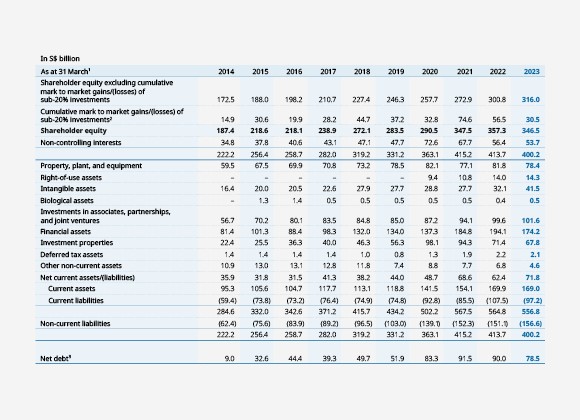

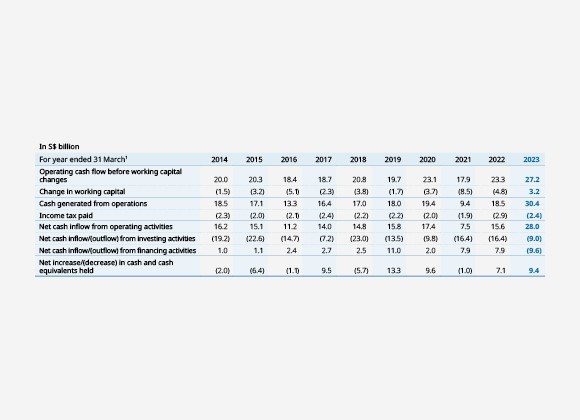

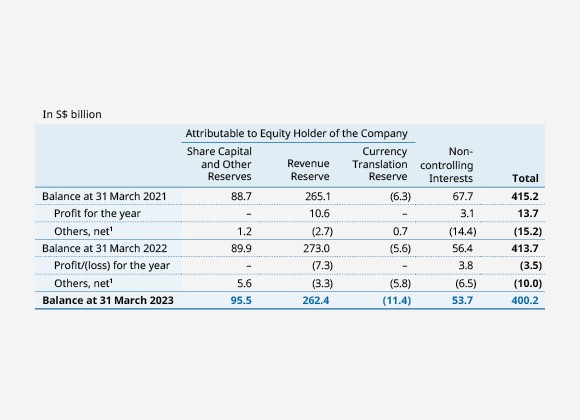

Group Financial Summary

-

Group Income Statements

-

Group Balance Sheets

-

Group Cash Flow Statements

-

Group Statements of Changes in Equity

-